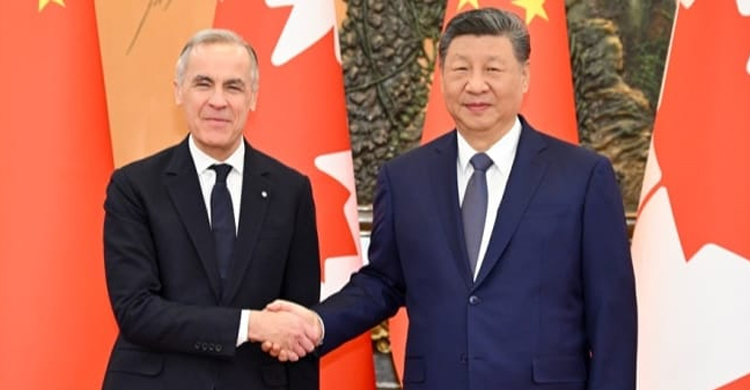

Chinese President Xi Jinping (centre L) and Canada`s Prime Minister Mark Carney (2nd R) attend a meeting at the Great Hall of the People in Beijing on January 16, 2026. – AFP Photo

Chinese leader Xi Jinping and Canadian PM Mark Carney have announced lower tariffs, signalling a reset in their countries` relationship after a key meeting in Beijing.

China is expected to lower levies on Canadian canola oil from 85% to 15% by 1 March, while Ottawa has agreed to tax Chinese electric vehicles at the most-favoured-nation rate, 6.1%, Carney told reporters.

The deal is a breakthrough after years of strained ties and tit-for-tat levies. Xi hailed the "turnaround" in their relationship but it is also a win for Carney, the first Canadian leader to visit China in nearly a decade.

He has been trying to diversify Canadian trade away from the US, his country`s biggest trading partner, following the uncertainty caused by Trump`s on-again-off-again tariffs.

The deal could also see more Chinese investments in Canada, right on America`s doorstep.

Carney himself seemed to allude to the fact that this was a result of Trump`s tariffs, which have now pushed one of the US`s key allies towards its biggest rival.

He told reporters that Canada`s relationship with China had been more "predictable" in recent months and that he found talks with Beijing "realistic and respectful".

He also made clear Ottawa does not agree with Beijing on everything, adding that in his discussions with Xi he made clear Canada`s "red lines", including human rights, concerns over election interference and the need for "guardrails".

"We take the world as it is - not as we wish it to be," he said when asked about China`s human rights record.

Observers believe Carney`s visit could set an example for other countries across the world who are also feeling the pain from Washington`s tariffs.

In contrast, Xi has been trying to show that China is a stable global partner and has been urging more pragmatic ties - in the words of Beijing, "a win-win" for all.

And it seems to be working. The South Korean president and the Irish prime minister have both visited Beijing in recent weeks. The UK prime minister is expected to visit soon and so is the German Chancellor.

Carney said the "world has changed dramatically" and how Canada positions itself "will shape our future for decades to come," he added.

Earlier in his three-day visit, he had said that the Canada-China partnership sets the two countries up for a "new world order". He later added that the multilateral system had been "eroded, to use a polite term, or undercut".

As the Chinese and Canadian delegations sat down in the Great Hall of the People on Friday, Xi said: "The healthy and stable development of China-Canada relations is conducive to world peace, stability, development, and prosperity."

A trade reset

Tariffs have been a key sticking point between the two sides.

In 2024, Canada imposed 100% tariffs on Chinese electric vehicles, following similar US curbs.

Last year, Beijing retaliated with tariffs on more than $2bn (£1.5bn) of Canadian farm and food products like canola seed and oil. As a result Chinese imports of Canadian goods fell by 10% in 2025.

In the deal struck on Friday, Canada will allow only 49,000 Chinese electric vehicles into the Canadian market at the 6.1% tariff rate.

The cap is in response to Canadian automakers` fears of an influx of affordable Chinese EVs.

As well as relief for canola producers, there will also be reduced tariffs on Canadian lobsters, crabs, and peas.

China is Canada`s second-largest trading partner but it`s still a long way behind the US in volume.

Economic ties with China are increasingly important for Carney. On arrival in Beijing on Wednesday, he met senior executives from prominent Chinese businesses, including an electric vehicle battery maker and an energy giant.

On Thursday the two countries signed several agreements on energy and trade cooperation.

The visit is a "reset of a relationship" that may be "modest in ambition" but "much more realistic about what we can reasonably obtain", said Colin Robertson, a former Canadian diplomat and vice-president at the Canadian Global Affairs Institute.

A frosty history

The last Canadian PM to visit China was Justin Trudeau, who met Xi in Beijing in 2017.

That visit took place before the relationship soured in 2018, following Canada`s arrest of Meng Wanzhou, the chief financial officer at the Chinese tech giant Huawai, at the request of the US.

Days later, China detained Canadian citizens Michael Kovrig and Michael Spavor on espionage charges - a move critics saw as retaliation for Meng`s arrest, which China denied.

Meng and both Michaels were released in 2021.

Ahead of the Carney-Xi meeting, Michael Kovrig wrote on X that the visit should not just be about warming ties but also "managing leverage".

Kovrig described Chinese negotiators as "extremely adroit, calculating, and always looking for leverage".

"That`s why engagement has to be handled with discipline," he wrote, adding that Carney should also advocate for Canadians imprisoned in China. There are about 100 of them, according to Canadian media.

Speaking to reporters, Carney was clear that with countries that do not share the same values, Ottawa will engage on a "narrower, more specific" manner.

"We`re very clear about where we cooperate, where we differ," he said, adding that Chinese claims over self-governed Taiwan and Hong Kong`s jailed pro-democracy figure Jimmy Lai came up in "broad discussions".

Canada and China have "different systems", he said, which limits the breadth of their cooperation.

"But to have an effective relationship, we have direct conversations. We don`t grab a megaphone and have the conversations that way."

Source: BBC

20161227174836.gif)